The Welcome Home Program

| Loan Options |

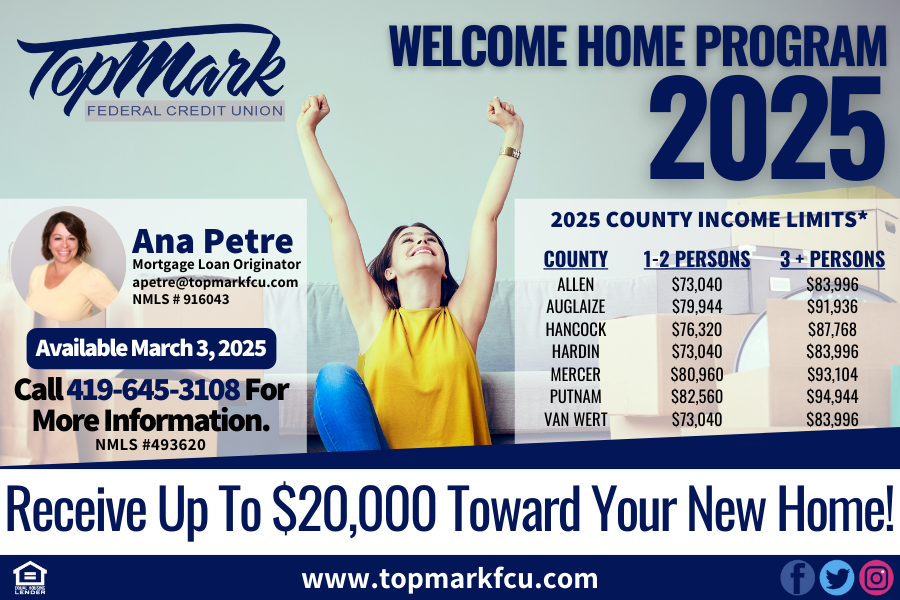

County Income Limits (2025 Figures)

|

County |

1-2 Persons |

3+ Persons |

|---|---|---|

|

Allen |

$ 73,040 |

$ 83,996 |

|

Auglaize |

$ 79,944 |

$ 91,936 |

|

Hancock |

$ 76,320 |

$ 87,768 |

|

Hardin |

$ 73,040 |

$ 83,996 |

|

Mercer |

$ 80,960 |

$ 93,104 |

|

Putnam |

$ 82,560 |

$ 94,944 |

|

Van Wert |

$ 73,040 | $ 83,996 |

Welcome Home Grant Facts

- $ 20,000 to use toward your down payment and/or closing costs.

- You can use this for your down payment. Whatever funds are left over can be used to go toward closing costs and prepaid expenses.

- You can use these funds even when the sellers are paying your closing costs for you.

We simply apply the remaining funds to pay down the principal balance of your loan. - You can use these funds even if you have a down payment of your own.

Credit Scores

While you do not have to maintain a certain credit score to qualify for Welcome Home Funds, you must be approved for a mortgage loan. This usually requires at least a 620 credit score.

Stipulations

- You have to use at least $500 of your own money in the transaction. For example, if you’ve already put down $500 in earnest money for your home purchase, that is all you need.

- You have to live in the home for at least 5 years. If you don’t, when you sell your home at a profit, Welcome Home will prorate the funds you have to pay back.

- You have to obtain home buyers counseling only if you are a first-time homebuyer — this is FREE with the Credit Union and can be done in our office or at home. This online course requires some reading and a small quiz. Once complete, you will get a certification to print and file.

- Your earnings must fall below median income guidelines - total household income.

- You do NOT have to be a first-time home buyer.

- You cannot own 2 homes at once. However, if you are doing a simultaneous closing you CAN qualify for the grant funds. You cannot keep your old home and buy a new one.

- Retention language must be added to the warranty deed explaining the five-year retention period.

- More information from the Federal Home Loan Bank of Cincinnati can be found at https://www.fhlbcin.com/housing-programs/welcome-home-program/

* TopMark is pleased to offer the Welcome Home Program through the Federal Home Loan Bank of Cincinnati.

All loans are subject to credit approval. A low contribution towards closing costs will be required from the borrower. Other terms and conditions may apply. If you live, work, or attend school in Allen or Auglaize County you can open an account!

TopMark NMLS #493620